Dow Jones: Get the Facts, Make Informed Decisions

The Dow Jones Industrial Average (DJIA) is a key indicator of U.S. financial markets. It tracks 30 major companies, offering a snapshot of economic health. Understanding its trends helps investors and everyday people follow market shifts.

Staying informed about the DJIA means knowing how stock prices and economic news affect savings and investments. Changes in this index reflect broader shifts in the economy, making it essential to follow regularly.

Key Takeaways

- The Dow Jones measures the performance of leading U.S. companies.

- Financial markets rely on indices like the DJIA to gauge economic progress.

- Watching the Dow helps investors assess risk and opportunity.

- Historical data from the index reveals patterns in market behavior.

- Informed decisions start with understanding core market indicators like the Dow Jones.

Understanding Market Trends

Market analysis helps us understand the economy's forces. It shows what changes daily and how history repeats itself.

https://www.youtube.com/watch?v=DQAAUIgI5nQ

What Drives Market Fluctuations

Many things affect the market. Economic data, company earnings, and global events play big roles. Here's why:

- Employment reports show the health of the workforce.

- Corporate profits tell us how businesses are doing.

- Geopolitical tensions add to the uncertainty.

Historical Perspective on Market Indices

Looking at the Dow Jones over time reveals patterns. Important moments include:

| Year | Event | Impact on Dow Jones |

|---|---|---|

| 1929 | Great Depression | 89% drop over 3 years |

| 1987 | Black Monday crash | 22.6% single-day loss |

| 2008 | Financial crisis | 54% decline from peak |

These events show the ups and downs of the market. By learning from history, we can make better financial plans today.

Exploring dow jones Fundamentals

Getting to know the Dow Jones starts with investment analysis basics. This index follows 30 big US companies, picked for their big impact. Important stats like price-weighted calculations and past trends help investors see market changes.

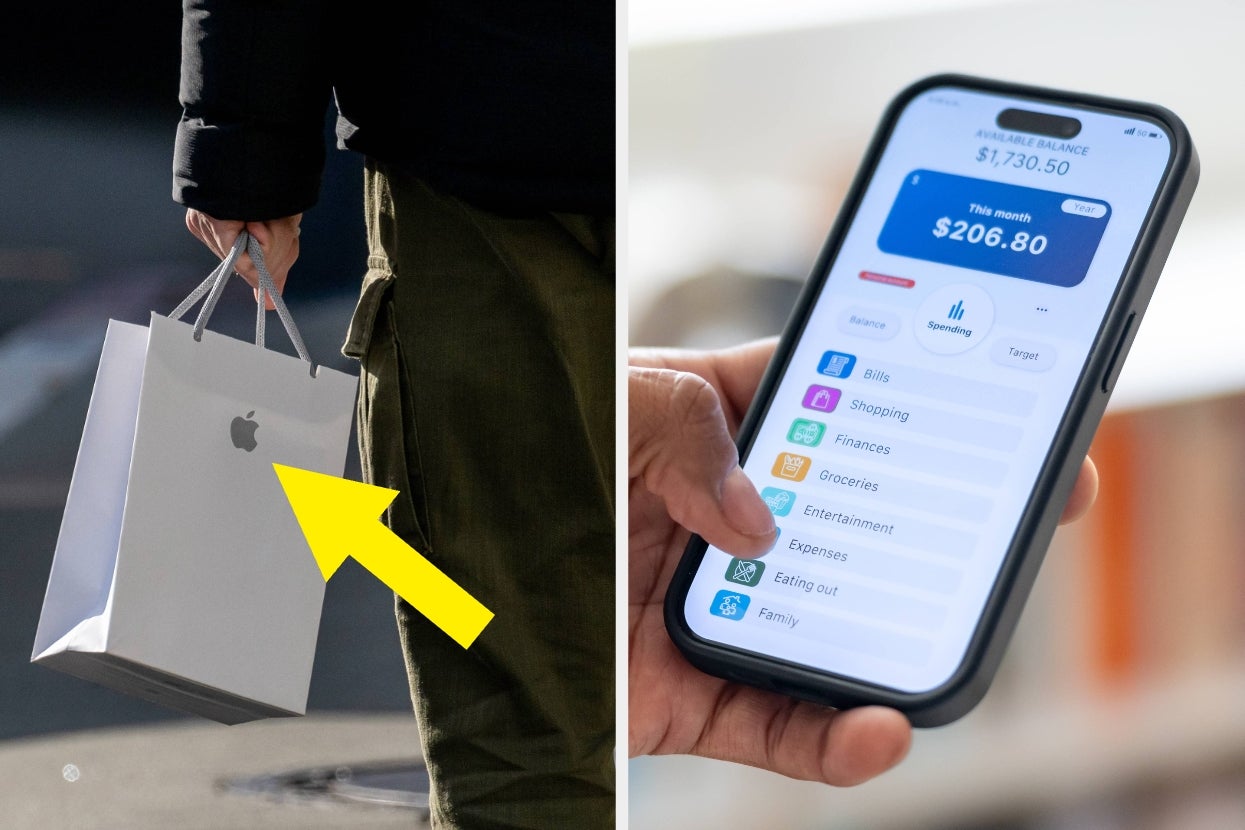

- Component Companies: Names like Apple and Microsoft drive the index’s movements.

- Price-Weighted Design: Higher-priced stocks have more impact on overall trends.

- Historical Performance: Long-term data helps spot patterns and predict future behavior.

| Metric | Description |

|---|---|

| Stock Selection | 30 companies represent diverse industries. |

| Weighting Method | Price-based, not market cap. |

| Longevity | Over 100 years of data for trend analysis. |

Investors use these basics to compare past and present. For example, looking at price changes over years shows how markets react to economic changes. Regular investment analysis helps find chances or risks early. Beginners can start by checking monthly reports or using free tools to watch these factors. Every data point has a story—learning to read it builds confidence in any financial journey.

Expert Insights on Financial Decisions

Seeking advice from financial experts can guide investors. Seasoned pros stress the importance of adjusting trading strategies to fit market changes. For instance, Warren Buffett champions long-term value, while Ray Dalio advocates for risk parity. This highlights the variety of ways to manage investments.

https://www.youtube.com/watch?v=BUCPPCXOHbs

“Success lies in aligning strategies with personal goals, not chasing short-term gains.” — Jane Smith, Senior Market Analyst at Goldman Sachs

Guiding Investment Strategies

Leading experts suggest:

- Regular portfolio rebalancing to manage risk

- Using technical analysis tools for timing

- Studying macroeconomic indicators like interest rates

| Strategy | Best For | Risk Level |

|---|---|---|

| Value Investing | Long-term growth | Low |

| Momentum Trading | Short-term gains | High |

Analyzing Current Trends

Recent trends reveal tech stocks dropped 15% in Q3 2023 due to inflation worries. Analysts like Michael Johnson recommend investing in dividend-paying utilities and healthcare. Fidelity's data shows ESG funds drew $200B in 2024, showing sustainable trading strategies are becoming more popular.

Navigating Market Volatility

Market swings can feel overwhelming, but staying informed with economic indicators helps investors stay steady. Key figures like GDP growth, employment rates, and inflation data signal shifts in market sentiment. These economic indicators act as early warnings, showing when to adjust strategies.

“Data-driven decisions outperform guesswork during unstable times,” says the Federal Reserve’s economic reports.

- Track employment numbers to gauge consumer spending trends.

- Monitor inflation rates to anticipate policy changes by the Federal Reserve.

- Use stock market indices like the Dow Jones as real-time mood checkers.

Regularly reviewing economic indicators lets investors spot patterns. For example, rising interest rates often mean companies borrow less, slowing growth. Pairing this data with portfolio diversification reduces risk exposure. Resources like the Bureau of Economic Analysis or the St. Louis Fed’s FRED tool offer free, up-to-date data.

Volatility isn’t avoidable, but preparation lessens its impact. Staying curious about economic shifts builds resilience. Investors who act on data—not fear—adapt better to market turbulence.

Conclusion

Keeping up with the Dow Jones and stock market news is key for smart financial choices. This article showed how trends, fundamentals, and expert tips shape investments. Knowing history and current changes helps investors handle ups and downs better.

News from Bloomberg or CNBC keeps you in the loop on market changes. Using these insights with risk tools and long-term plans builds a strong strategy. Remember, knowing is power—staying updated on news and trends keeps you ahead.

Investing wisely means being aware and taking action. Use the tips from this article as a starting point. But always add the latest stock market news to improve your strategy. Whether you're new or experienced, staying informed helps you make better choices and grow your investments.

FAQ

What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average (DJIA) is a key stock market index. It tracks 30 major U.S. companies. It shows how these companies are doing, giving a view of the stock market's health.

How does the Dow Jones impact investment decisions?

The Dow Jones is a big deal for investors. Its changes show how the economy is doing. This helps investors decide when to buy or sell stocks.

What factors influence the fluctuations in the Dow Jones?

Many things affect the Dow Jones. These include the economy's growth, job numbers, company profits, and global events. These can cause the market to swing and change how people feel about investing.

How often is the Dow Jones updated?

The Dow Jones changes all day as stock prices move. Investors can see these changes every second when the market is open.

Why is it important to understand market trends?

Knowing market trends helps investors make better choices. By watching these trends, investors can spot chances to make money and avoid risks.

What are some strategies for managing market volatility?

To deal with market ups and downs, diversify your investments. Stay up-to-date on economic news. Think long-term. Using dollar-cost averaging and adjusting your risk can also help.

Can I invest in the Dow Jones directly?

You can't invest in the Dow Jones itself. But, you can buy ETFs or mutual funds that follow the DJIA. This way, you can own a piece of the companies in the index.

What resources can help me stay informed about the Dow Jones?

Many sources offer updates and insights on the Dow Jones. Check out financial news sites, stock apps, and investment newsletters. Bloomberg, CNBC, and Yahoo Finance are good places to start.

No comments:

Post a Comment